No part of this material may be reproduced in any form, or related to in any other publication, without express written. PIMCO Canada will remain responsible for any loss that arises out of the failure of its sub-adviser.

PIMCO Canada has retained PIMCO LLC as sub-adviser. may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. The products and services provided by PIMCO Canada Corp.

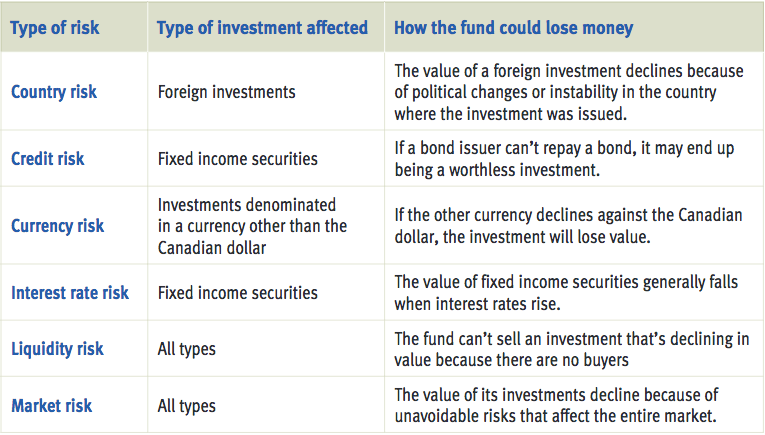

Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Government portfolios that invest in such securities are not guaranteed and will fluctuate in value.

BEST PERFORMING MUTUAL FUNDS CANADA 2015 FULL

Government agencies and authorities are supported by varying degrees but are generally not backed by the full faith of the U.S. Sovereign securities are generally backed by the issuing government, obligations of the U.S. For a complete description of the risks associated with a particular Fund, please refer to the Fund’s prospectus. Investing in derivatives could lose more than the amount invested. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous.

Equities may decline in value due to both real and perceived general market, economic and industry conditions. Bond investments may be worth more or less than the original cost when redeemed. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. All investments contain risk and may lose value. Past performance is not a guarantee or a reliable indicator of future results. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Please read the prospectus before investing. Interested investors should obtain a copy of the prospectus, which is available from your Financial Advisor.Ĭommissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. No offering is being made by this material. Our ExpertiseĪ longtime investment manager, Mark Kiesel is the CIO of Global Credit, the global head of PIMCO's corporate bond portfolio management group and a senior member of the investment strategy and portfolio management group. Extensive credit resources and researchĮmploying a disciplined approach to credit research, the fund accesses PIMCO’s team of more than 50 bottom-up credit investment professionals and utilizes top-down, bottom-up and valuation screens to identify what we believe are the most attractive opportunities in global credit markets. government bonds, mortgages and foreign bonds. The fund has the ability to broadly diversify across industries, issuers and regions of the corporate bond sector and can seek to add value through investments in high quality U.S. The fund aims to provide investors with greater income potential relative to Treasuries and cash, as well as more income and less volatility in returns when compared to equity indexes. Why Invest in This Fund? Attractive total return potential Fund Overview Seeks attractive returns from high quality corporate bondsĬombining PIMCO’s forward-looking macroeconomic outlook and extensive bottom-up credit research, the fund helps investors take advantage of opportunities in higher-quality corporate bonds.

0 kommentar(er)

0 kommentar(er)